Multiple Choice

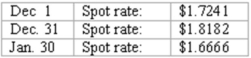

Norton Co., a U.S. corporation, sold inventory on December 1, 2013, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on January 30?

What amount of foreign exchange gain or loss should be recorded on January 30?

A) $1,516 gain.

B) $1,516 loss.

C) $575 loss.

D) $500 loss.

E) $500 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: How is the fair value of a

Q10: When a U.S. company purchases parts from

Q38: U.S. GAAP provides guidance for hedges of

Q48: Alpha Inc., a U.S. company, had a

Q49: On April 1, Quality Corporation, a U.S.

Q49: A company has a discount on a

Q50: On October 1, 2013, Eagle Company forecasts

Q56: Norton Co., a U.S. corporation, sold inventory

Q57: Winston Corp., a U.S. company, had the

Q103: What happens when a U.S. company sells