Multiple Choice

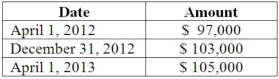

On April 1, 2012, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2013. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2013 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2013 income statement?

A) $1,000 gain.

B) $1,000 loss.

C) $2,000 gain.

D) $2,000 loss.

E) $8,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Old Colonial Corp. (a U.S. company) made

Q13: On November 10, 2013, King Co. sold

Q14: Atherton Inc., a U.S. company, expects to

Q15: Woolsey Corporation, a U.S. company, expects to

Q18: On October 1, 2013, Jarvis Co. sold

Q19: Car Corp. (a U.S.-based company) sold parts

Q20: On November 10, 2013, King Co. sold

Q22: Larson Company, a U.S.company, has an India

Q65: Yelton Co.just sold inventory for 80,000 euros,

Q72: What factors create a foreign exchange gain?