Multiple Choice

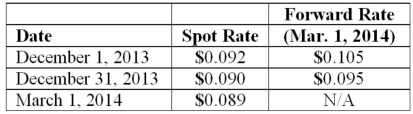

On December 1, 2013, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2014, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply:  Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2013 balance sheet for the forward contract?

Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2013 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $500.00 liability.

D) $490.15 asset.

E) $490.15 liability.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: On May 1, 2013, Mosby Company received

Q28: Coyote Corp. (a U.S. company in Texas)

Q29: Belsen purchased inventory on December 1, 2012.

Q30: On December 1, 2013, Keenan Company, a

Q31: On March 1, 2013, Mattie Company received

Q33: On April 1, 2012, Shannon Company, a

Q35: Coyote Corp. (a U.S. company in Texas)

Q36: On December 1, 2013, Keenan Company, a

Q37: Mills Inc. had a receivable from a

Q100: A U.S. company buys merchandise from a