Multiple Choice

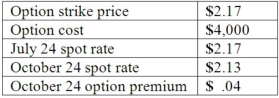

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:  What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

A) $6,000 positive.

B) $6,000 negative.

C) $10,000 positive.

D) $10,000 negative.

E) $14,000 positive.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When a U.S. company purchases parts from

Q26: A U.S. company sells merchandise to a

Q31: Meisner Co.ordered parts costing §100,000 for a

Q39: Williams, Inc., a U.S.company, has a Japanese

Q56: Norton Co., a U.S. corporation, sold inventory

Q57: Winston Corp., a U.S. company, had the

Q59: Coyote Corp. (a U.S. company in Texas)

Q62: Coyote Corp. (a U.S. company in Texas)

Q63: Gaw Produce Company purchased inventory from a

Q66: Car Corp. (a U.S.-based company) sold parts