Multiple Choice

Cement Company, Inc. began the first quarter with 1,000 units of inventory costing $25 per unit. During the first quarter, 3,000 units were purchased at a cost of $40 per unit, and sales of 3,400 units at $65 per units were made. During the second quarter, the company expects to replace the units of beginning inventory sold at a cost of $45 per unit. Cement Company uses the LIFO method to account for inventory.

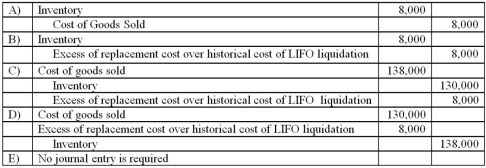

What is the correct journal entry to record cost of goods sold at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Correct Answer:

Verified

Q32: What is the appropriate treatment in an

Q33: Which of the following is not a

Q34: What approach is used, according to U.S.

Q35: How should contingencies be reported in an

Q36: The Fratilo Co. had three operating segments

Q38: Schilling, Inc. has three operating segments with

Q39: Provo, Inc. has an estimated annual tax

Q40: The hardware operating segment of Bloom Corporation

Q41: Elektronix, Inc. has three operating segments with

Q42: On February 23, 2013, Cleveland, Inc. paid