Essay

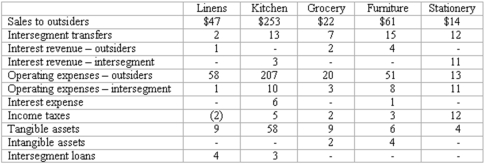

Blanton Corporation is comprised of five operating segments. Information about each of these segments is as follows (in thousands):

Required:

(a.) Which operating segments are reportable under the revenue test?

(b.) What is the total amount of revenues in applying the revenues test?

(c.) Which operating segments are reportable under the profit or loss test?

(d.) In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

(e.) Which operating segments are reportable under the asset test?

(f.) In applying the asset test, what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

(g.) Which operating segments are reportable?

(h.) According to the test results for reportable segments, is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Which of the following statements is true?<br>A)

Q28: Which of the following is false with

Q41: What is the appropriate treatment in an

Q89: Which of the following would be an

Q90: The Fratilo Co. had three operating segments

Q93: Dean Hardware, Inc. is comprised of five

Q94: Baker Corporation changed from the LIFO method

Q96: Natarajan, Inc. had the following operating segments,

Q97: Vapor Corporation has a fan products operating

Q99: According to International Financial Reporting Standards (IFRS),