Essay

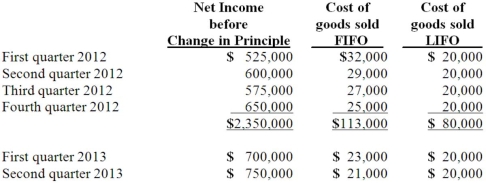

Harrison Company, Inc. began operations on January 1, 2012, and applied the LIFO method for inventory valuation. On June 10, 2013, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:

The LIFO method was applied during the first quarter of 2013 and the FIFO method was applied during the second quarter of 2013 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Compute the after-tax effect of Harrison's change in inventory method.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Kaycee Corporation's revenues for the year ended

Q19: The following information for Urbanski Corporation relates

Q20: Which tests must a company use to

Q21: The following information for Urbanski Corporation relates

Q22: According to U.S. GAAP, what general information

Q25: How should seasonal revenues be reported in

Q26: Faru Co. identified five industry segments: (1)

Q27: What is the appropriate treatment in an

Q28: Which of the following is not true

Q30: According to U.S. GAAP, what revenues and