Multiple Choice

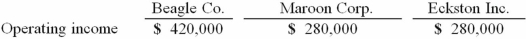

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2013 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.  The accrual-based income of Maroon Corp. is calculated to be

The accrual-based income of Maroon Corp. is calculated to be

A) $481,600.

B) $472,700.

C) $488,900.

D) $502,300.

E) $358,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: White Company owns 60% of Cody Company.

Q27: Buckette Co. owned 60% of Shuvelle Corp.

Q27: Jastoon Co.acquired all of Wedner Co.for $588,000

Q29: Paris, Inc. owns 80 percent of the

Q33: On January 1, 2012, Mace Co. acquired

Q34: On January 1, 2012, Mace Co. acquired

Q35: West Corp. owned 70% of the voting

Q61: Which of the following is true concerning

Q92: Under current U.S. tax law for consolidated

Q107: What are the benefits or advantages of