Multiple Choice

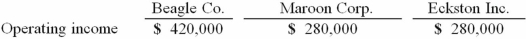

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2013 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.  The accrual-based income of Beagle Co. is calculated to be

The accrual-based income of Beagle Co. is calculated to be

A) $706,670.

B) $755,980.

C) $805,280.

D) $838,150.

E) $815,770.

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Which of the following statements is true

Q86: Which of the following statements is true

Q105: White Company owns 60% of Cody Company.

Q106: West Corp. owned 70% of the voting

Q108: Alpha Corporation owns 100 percent of Beta

Q109: River Co. owned 80% of Boat Inc.

Q110: B Co. owned 70% of the voting

Q112: Hardford Corp. held 80% of Inglestone Inc.

Q114: When indirect control is present, which of

Q115: Kurton Inc. owned 90% of Luvyn Corp.'s