Multiple Choice

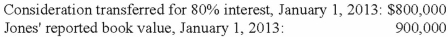

On January 1, 2012, Jones Company bought 15% of Whitton Company. Jones paid $150,000 for these shares, an amount that exactly equaled the proportionate book value of Whitton. On January 1, 2013, Whitton acquired 80% ownership of Jones. The following data are available concerning Whitton's acquisition of Jones:  Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

Excess fair value over book value (assigned to trademarks) is amortized over 20 years.

The initial value method is used by both companies.

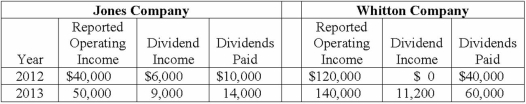

The following information is available regarding Jones and Whitton:

Compute Whitton's accrual-based consolidated net income for 2013.

A) $199,000.

B) $190,000.

C) $185,000.

D) $184,000.

E) $176,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Woods Company has one depreciable asset valued

Q6: On January 1, 2012, Jones Company bought

Q7: Horse Corporation acquires all of Pony, Inc.for

Q7: Dice Inc. owns 40% of the outstanding

Q8: Tower Company owns 85% of Hill Company.

Q9: Delta Corporation owns 90 percent of Sigma

Q10: West Corp. owned 70% of the voting

Q21: How is goodwill amortized?<br>A) It is not

Q33: How is the amortization of goodwill treated

Q100: Buckette Co. owned 60% of Shuvelle Corp.