Multiple Choice

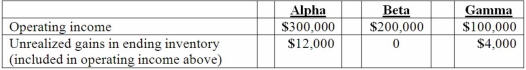

Alpha Corporation owns 100 percent of Beta Company, and Beta owns 80 percent of Gamma, Inc. all of which are domestic corporations. Information for the three companies for the year ending December 31, 2013 follows:  Which of the following statements is true?

Which of the following statements is true?

A) Alpha and Beta must file a consolidated income tax return, but must exclude Gamma from the consolidated return.

B) Alpha, Beta, and Gamma must file a consolidated income tax return.

C) Alpha, Beta, and Gamma must file separate income tax returns because the ownership of Beta is less than 100%.

D) Alpha, Beta, and Gamma will probably not file a consolidated income tax return.

E) Alpha, Beta, and Gamma may file separate income tax returns or a consolidated income tax return.

Correct Answer:

Verified

Correct Answer:

Verified

Q76: On January 1, 2012, Mace Co. acquired

Q77: Jull Corp. owned 80% of Solaver Co.

Q78: On January 1, 2013, a subsidiary buys

Q79: Reggie, Inc. owns 70 percent of Nancy

Q80: Dotes, Inc. owns 40% of Abner Co.

Q82: River Co. owned 80% of Boat Inc.

Q83: Which of the following is not an

Q84: On January 1, 2013, a subsidiary bought

Q85: According to International Financial Reporting Standards: In

Q86: Alpha Corporation owns 100 percent of Beta