Multiple Choice

These questions are based on the following information and should be viewed as independent situations.

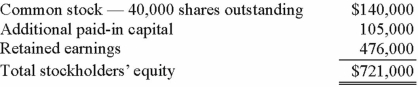

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2011, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2014.

On January 1, 2014, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2014, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not acquire any of this newly issued stock. How would this transaction affect the additional paid-in capital of the parent company?

A) $0.

B) decrease it by $23,240.

C) decrease it by $68,250.

D) decrease it by $45,060.

E) decrease it by $43,680.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Parent Corporation had just purchased some of

Q69: Regency Corp. recently acquired $500,000 of the

Q70: Tray Co. reported current earnings of $560,000

Q71: Panton, Inc. acquired 18,000 shares of Glotfelty

Q72: On January 1, 2013, Riney Co. owned

Q73: Cadion Co. owned a controlling interest in

Q75: Davidson, Inc. owns 70 percent of the

Q76: On January 1, 2013, Nichols Company acquired

Q78: Which one of the following characteristics of

Q79: Ryan Company owns 80% of Chase Company.