Multiple Choice

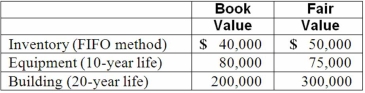

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2012. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $400,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2014, assuming the book value of the building at that date is still $200,000?

If Watkins pays $400,000 in cash for Glen, what amount would be represented as the subsidiary's Building in a consolidation at December 31, 2014, assuming the book value of the building at that date is still $200,000?

A) $200,000.

B) $285,000.

C) $260,000.

D) $268,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: From which methods can a parent choose

Q77: Paperless Co. acquired Sheetless Co. and in

Q110: Parrett Corp. acquired one hundred percent of

Q111: Fesler Inc. acquired all of the outstanding

Q112: On 4/1/11, Sey Mold Corporation acquired 100%

Q113: Why is push-down accounting a popular internal

Q114: Kaye Company acquired 100% of Fiore Company

Q116: Carnes Co. decided to use the partial

Q117: Prince Company acquires Duchess, Inc. on January

Q118: An acquisition transaction results in $90,000 of