Multiple Choice

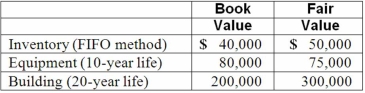

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2012. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2012, what amount would be reflected in consolidated net income for 2012 as a result of the acquisition?

If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2012, what amount would be reflected in consolidated net income for 2012 as a result of the acquisition?

A) $20,000 under the initial value method.

B) $30,000 under the partial equity method.

C) $50,000 under the partial equity method.

D) $44,500 under the equity method.

E) $45,500 regardless of the internal accounting method used.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: For each of the following situations, select

Q55: On January 1, 2012, Franel Co. acquired

Q56: Harrison, Inc. acquires 100% of the voting

Q57: Push-down accounting is concerned with the<br>A) impact

Q60: Harrison, Inc. acquires 100% of the voting

Q61: When a company applies the initial value

Q62: On January 1, 2011, Rand Corp. issued

Q63: Which of the following internal record-keeping methods

Q64: For an acquisition when the subsidiary maintains

Q64: Perry Company acquires 100% of the stock