Essay

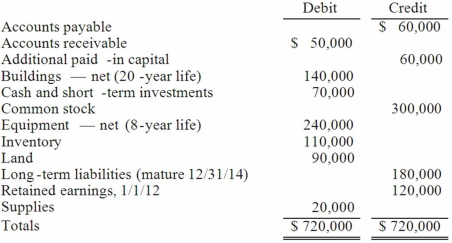

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2012. As of that date, Jackson had the following trial balance:

During 2012, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2013, Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2012, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2012.

(B.) Prepare consolidation worksheet entries for December 31, 2013.

Correct Answer:

Verified

_TB2311_00...

_TB2311_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: For an acquisition when the subsidiary retains

Q78: Red Co. acquired 100% of Green, Inc.

Q79: Hoyt Corporation agreed to the following terms

Q80: Watkins, Inc. acquires all of the outstanding

Q81: Following are selected accounts for Green Corporation

Q82: Beatty, Inc. acquires 100% of the voting

Q85: Pritchett Company recently acquired three businesses, recognizing

Q86: Hanson Co. acquired all of the common

Q87: Perry Company acquires 100% of the stock

Q88: Consolidated net income using the equity method