Multiple Choice

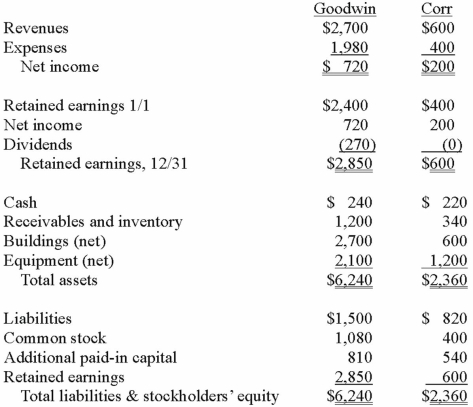

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

In this acquisition business combination, what total amount of common stock and additional paid-in capital is added on Goodwin's books?

A) $265.

B) $1,165.

C) $1,200.

D) $1,235.

E) $1,765.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Which of the following is a not

Q70: The financial balances for the Atwood Company

Q71: Presented below are the financial balances for

Q72: For each of the following situations, select

Q73: The financial balances for the Atwood Company

Q74: Acquired in-process research and development is considered

Q76: Which one of the following is a

Q79: On January 1, 2013, the Moody Company

Q80: On January 1, 2013, the Moody Company

Q110: Which of the following statements is true