Multiple Choice

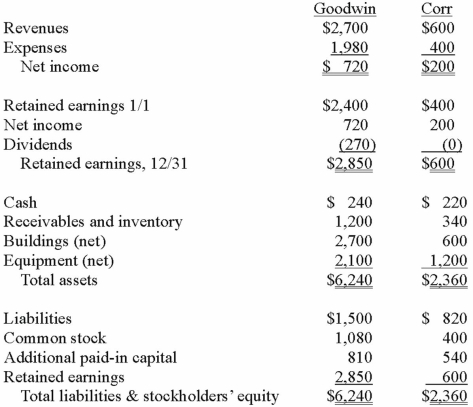

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 2013.

A) $1,200.

B) $1,515.

C) $1,540.

D) $1,800.

E) $2,140.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Which of the following statements is true

Q80: On January 1, 2013, the Moody Company

Q81: An example of a difference in types

Q82: Prior to being united in a business

Q83: Bullen Inc. acquired 100% of the voting

Q84: Presented below are the financial balances for

Q86: Bullen Inc. acquired 100% of the voting

Q88: Bullen Inc. acquired 100% of the voting

Q89: Salem Co. had the following account balances

Q106: Elon Corp. obtained all of the common