Multiple Choice

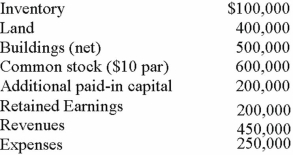

Carnes has the following account balances as of May 1, 2012 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2012, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

A) $0.

B) $440,000 increase.

C) $450,000 increase.

D) $640,000 increase.

E) $650,000 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: How are direct combination costs, contingent consideration,

Q19: The financial balances for the Atwood Company

Q21: How are bargain purchases accounted for in

Q23: Flynn acquires 100 percent of the outstanding

Q26: Flynn acquires 100 percent of the outstanding

Q27: The financial statements for Goodwin, Inc. and

Q39: Which of the following statements is true

Q95: Describe the accounting for direct costs, indirect

Q99: Peterman Co. owns 55% of Samson Co.

Q116: Fine Co. issued its common stock in