Multiple Choice

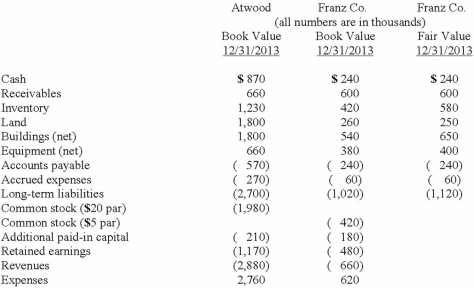

The financial balances for the Atwood Company and the Franz Company as of December 31, 2013, are presented below. Also included are the fair values for Franz Company's net assets.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31, 2013. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated buildings (net) at the date of the acquisition.

A) $2,450.

B) $2,340.

C) $1,800.

D) $650.

E) $1,690.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A statutory merger is a(n)<br>A) business combination

Q41: Flynn acquires 100 percent of the outstanding

Q42: The financial balances for the Atwood Company

Q43: Presented below are the financial balances for

Q44: On January 1, 2013, the Moody Company

Q46: The financial balances for the Atwood Company

Q47: The financial statements for Goodwin, Inc. and

Q48: The financial balances for the Atwood Company

Q78: What is the primary difference between recording

Q89: What is the difference in consolidated results