Essay

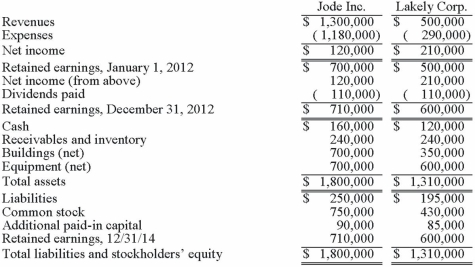

The financial statements for Jode Inc. and Lakely Corp., just prior to their combination, for the year ending December 31, 2012, follow. Lakely's buildings were undervalued on its financial records by $60,000.

On December 31, 2012, Jode issued 54,000 new shares of its $10 par value stock in exchange for all the outstanding shares of Lakely. Jode's shares had a fair value on that date of $35 per share. Jode paid $34,000 to an investment bank for assisting in the arrangements. Jode also paid $24,000 in stock issuance costs to effect the acquisition of Lakely. Lakely will retain its incorporation.

Determine consolidated Additional paid-in Capital at December 31, 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: In a transaction accounted for using the

Q7: Flynn acquires 100 percent of the outstanding

Q8: Flynn acquires 100 percent of the outstanding

Q9: Carnes has the following account balances as

Q10: Presented below are the financial balances for

Q12: Prior to being united in a business

Q13: The financial statements for Goodwin, Inc. and

Q14: Flynn acquires 100 percent of the outstanding

Q15: The financial statements for Goodwin, Inc. and

Q16: Bullen Inc. acquired 100% of the voting