Multiple Choice

The Black-Scholes-Merton model for European puts, obtained by applying put-call parity to the Black-Scholes-Merton model for European calls, is customarily expressed by which of the following:

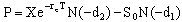

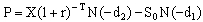

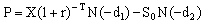

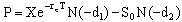

A)

B)

C)

D)

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q2: An approximate implied volatility for an at-the-money

Q15: The relationship between the volatility and the

Q17: Which of the following characteristics of the

Q29: In the term structure of volatility,the forward

Q32: The following information is given about

Q36: The volatility smile is the relationship between

Q37: The Black-Scholes-Merton model can be used with

Q48: An option's gamma represents the risk of

Q54: The option's delta is approximately the change

Q56: The binomial price will theoretically equal the