Multiple Choice

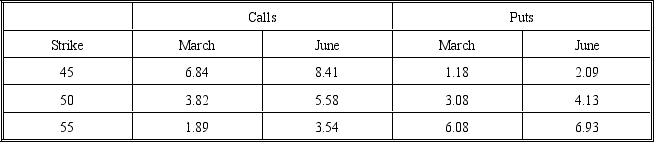

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Answer questions 12 through 17 about a long straddle constructed using the June 50 options.

-What is the profit if the position is held for 90 days and the stock price is $55?

A) -$971

B) -$58

C) -$109

D) -$471

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q33: A ratio spread can be conducted with

Q34: The following prices are available for call

Q35: The following prices are available for call

Q36: The following prices are available for call

Q37: A spread option strategy is a transaction

Q39: The delta of a straddle would be

Q40: The following prices are available for call

Q41: The following prices are available for call

Q42: "Like the butterfly spread,the calendar spread is

Q43: The following prices are available for call