Multiple Choice

The following information pertains to questions

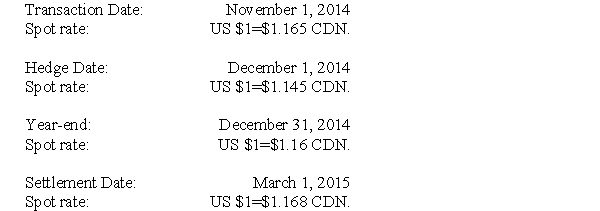

RXN's year-end is on December 31.On November 1,2014 when the U.S.dollar was worth $1.165 CDN,RXN sold merchandise to an American client for $300,000.Full payment of this invoice was expected by January 31,2015.On December 1,the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN.

In order to minimize its Foreign Exchange risk and exposure,RXN entered into a contract with its bank on December 1,2014 to deliver $300,000 U.S.in three months time.The spot rate at year-end was $1.16 CDN.On March 1,2015,RXN received the $300,000 U.S.from its client and settled its contract with the bank.

Significant dates pertaining to this transaction are as follows:

-What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

A) Nil

B) A $6000 loss.

C) A $6,000 gain.

D) A $4,500 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The following information pertains to questions <br>On

Q21: The following information refers to questions <br>On

Q22: IAS 39 on speculative forward exchange contracts

Q23: The following information pertains to questions <br>On

Q26: The following information pertains to questions<br>On July

Q27: The following information pertains to questions <br>ABC

Q28: Which statement is NOT correct?<br>A)In a fair

Q29: The following information pertains to questions <br>XYZ

Q53: Canada Corp. sells raw lumber to

Q60: Which of the following is NOT currently