Short Answer

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on July 31,2007:  The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

The Net Incomes for Parent and Sub Inc for the year ended July 31,2007 were $120,000 and $60,000 respectively.

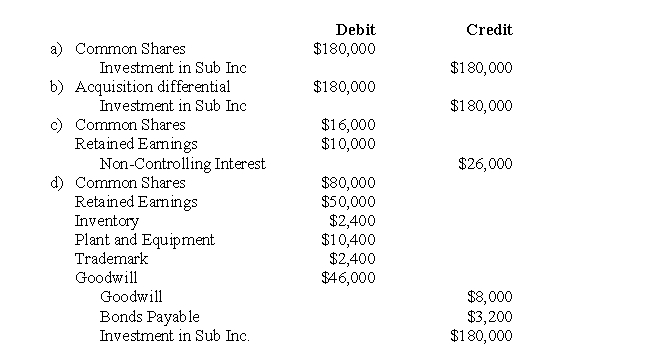

-Assuming that Parent Inc.purchased 80% of Sub's voting shares on the date of acquisition for $180,000,what would be the journal entry to clear out the Investment in Sub Inc.account assuming any Acquisition differential is to be allocated to the identifiable assets and liabilities of Sub Inc if the Proprietary Method were used?

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The following data pertains to questions <br>Parent

Q12: On the date of acquisition,the parent's investment

Q13: Assume the same facts as Question 62

Q15: The following data pertains to questions <br>Parent

Q16: Contingent consideration will be classified as a

Q17: Under the Parent Company Theory,which of the

Q18: Under "push-down" accounting,a subsidiary's assets and liabilities

Q19: The following data pertains to Questions<br>Keen and

Q20: The following data pertains to questions <br>Parent

Q53: Any negative goodwill arising on the date