Multiple Choice

The following data pertains to questions

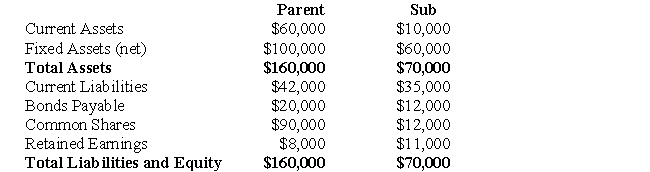

Parent and Sub Inc had the following balance sheets on December 31,2008:  On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

-How much Goodwill was amortized during 2003?

A) $700

B) ($1,700)

C) $1,700

D) None - Goodwill is never amortized.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Which of the following would not be

Q20: The carrying value of Depreciable Assets on

Q21: A Inc.purchases 100% of the voting shares

Q25: Which of the following must be possible

Q26: The following data pertains to questions <br>Parent

Q27: A Inc purchased 100% of B Inc's

Q28: A Inc.has purchased all of the outstanding

Q29: Which of the following statements is correct?<br>A)Under

Q38: Which of the following pertaining to Consolidated

Q55: During an acquisition, when should intangible assets