Multiple Choice

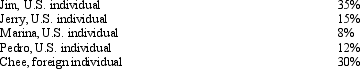

The following persons own Good Corporation,a foreign corporation.

None of the shareholders are related.Subpart F income for the tax year is $200,000.No distributions are made.Which of the following statements is correct?

A) Good Corporation is not a CFC.

B) Chee includes $60,000 in gross income.

C) Marina includes $16,000 in gross income.

D) Marina is not a U.S.shareholder.

E) None of the above statements is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Which of the following statements best describes

Q29: Which of the following statements regarding the

Q39: Discuss the primary purposes of income tax

Q105: Which of the following is a true

Q107: The existence of a U.S.trade or business

Q108: Which of the following statements regarding the

Q110: Given the following information,determine if FanCo,a foreign

Q119: Interest paid to an unrelated party by

Q123: Performance,Inc. ,a U.S.corporation,owns 100% of Krumb,Ltd. ,a

Q143: Copp,Inc. ,a domestic corporation,owns 40% of a