Multiple Choice

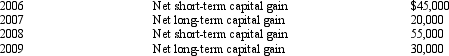

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2010.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:

Compute the amount of Bear's capital loss carryover to 2011.

A) $0.

B) $105,000.

C) $165,000.

D) $200,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Unlike individual taxpayers, corporate taxpayers do not

Q35: Juanita owns 45% of the stock in

Q39: Jake,the sole shareholder of Peach Corporation,a C

Q53: Cecelia is the sole shareholder of Aqua

Q79: Generally,corporate net operating loss can be carried

Q80: A corporation that is not required to

Q83: As a general rule,a personal service corporation

Q84: Shaw,an architect,is the sole shareholder of Shaw

Q93: Shareholders of closely held C corporations frequently

Q102: Which of the following statements is incorrect