Multiple Choice

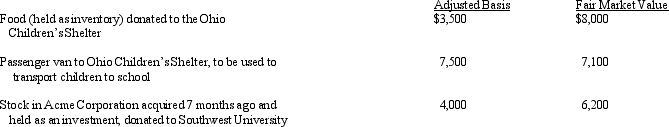

Grocer Services Corporation (a calendar year taxpayer) ,a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:

How much qualifies for the charitable contribution deduction?

A) $15,000.

B) $16,850.

C) $17,250.

D) $19,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Sage, Inc., a closely held corporation that

Q6: Discuss the purpose of Schedule M-1.Give two

Q17: Unlike individual taxpayers, corporate taxpayers do not

Q17: Canary Corporation,which sustained a $5,000 net capital

Q24: Herman and Henry are equal partners in

Q52: On December 31,2010,Lavender,Inc. ,an accrual basis C

Q64: Eagle Company,a partnership,had a long-term capital gain

Q66: The passive loss rules apply to noncorporate

Q72: Red Corporation,which owns stock in Blue Corporation,had

Q75: In the current year,Amber,Inc. ,a calendar C