Multiple Choice

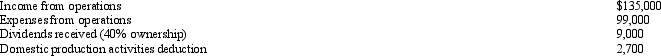

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

A) $0.

B) $4,230.

C) $4,500.

D) $6,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: George Judson is the sole shareholder and

Q34: On December 20,2010,the directors of Quail Corporation

Q37: Falcon Corporation,a C corporation,had gross receipts of

Q44: Income that is included in net income

Q45: Pierre is the sole shareholder of Pine

Q49: Eagle Corporation owns stock in Hawk Corporation

Q56: Compensation that is determined to be unreasonable

Q77: Quail Corporation is a C corporation with

Q89: In the current year,Plum Corporation,a computer manufacturer,donated

Q96: On April 8,2010,Oriole Corporation donated a painting