Essay

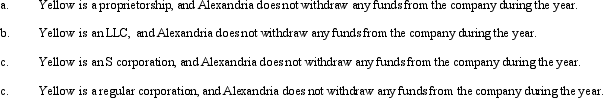

During the current year,Yellow Company had operating income of $380,000 and operating expenses of $300,000.In addition,Yellow had a long-term capital loss of $50,000.Based on this information,how does Alexandria,the sole owner of Yellow Company,report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: All corporations that maintain inventory for sale

Q6: George Judson is the sole shareholder and

Q37: Falcon Corporation,a C corporation,had gross receipts of

Q49: Eagle Corporation owns stock in Hawk Corporation

Q52: A corporation may elect to amortize startup

Q56: Compensation that is determined to be unreasonable

Q59: Nancy is a 40% shareholder and president

Q87: Starling Corporation,a closely held personal service corporation,has

Q91: Which of the following statements is correct

Q103: Fender Corporation was organized in 2008 and