Essay

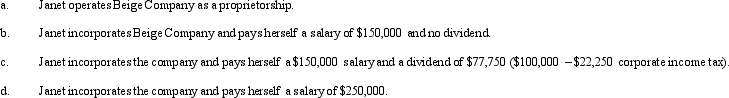

Beige Company has approximately $250,000 in net income in 2010 before deducting any compensation or other payment to its sole owner,Janet (who is single).Assume that Janet is in the 35% marginal tax bracket.Discuss the tax aspects of each of the following arrangements.(Ignore any employment tax considerations. )

Correct Answer:

Verified

Correct Answer:

Verified

Q4: For a corporation in 2010,the domestic production

Q15: Maize Corporation had $200,000 operating income and

Q22: Orange Corporation owns stock in White Corporation

Q25: Egret Corporation,a calendar year C corporation,had an

Q27: Briefly describe the accounting methods available for

Q27: Elk,a C corporation,has $500,000 operating income and

Q36: Albatross,a C corporation,had $125,000 net income from

Q55: Flycatcher Corporation,a C corporation,has two equal individual

Q91: Under the "check-the-box" Regulations, a single-member LLC

Q94: Schedule M-1 of Form 1120 is used