Essay

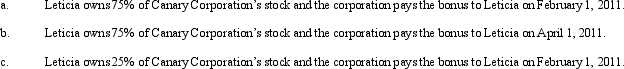

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2010,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Correct Answer:

Verified

Under § 267(a)(2),an accrual method taxp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: All corporations that maintain inventory for sale

Q16: A corporation with $10 million or more

Q19: Olga's proprietorship earned a net profit of

Q38: Donald owns a 40% interest in a

Q52: A corporation may elect to amortize startup

Q59: Nancy is a 40% shareholder and president

Q67: In connection with the deduction of organizational

Q71: Geneva,a sole proprietor,sold one of her business

Q87: Starling Corporation,a closely held personal service corporation,has

Q91: Which of the following statements is correct