Essay

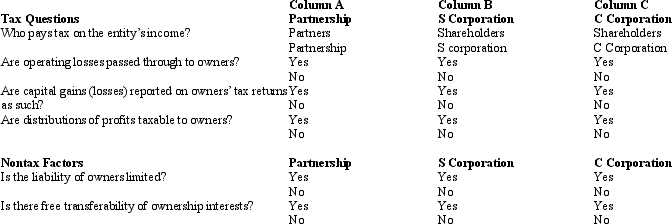

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: A corporation with $10 million or more

Q19: Olga's proprietorship earned a net profit of

Q38: Donald owns a 40% interest in a

Q67: In connection with the deduction of organizational

Q69: During the current year,Coyote Corporation (a calendar

Q71: Geneva,a sole proprietor,sold one of her business

Q71: Patrick,an attorney,is the sole shareholder of Gander

Q73: During the current year,Quartz Corporation (a calendar

Q100: Nicole owns and operates a sole proprietorship.She

Q102: Glen and Michael are equal partners in