Multiple Choice

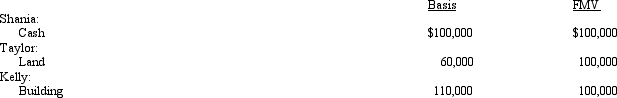

Shania,Taylor,and Kelly form a corporation with the following contributions.

A) If the corporation is a C corporation,Taylor has a recognized gain of $40,000,a stock basis of $100,000,and the corporation has a basis for the land of $100,000.

B) If the corporation is an S corporation,Kelly has a recognized gain or loss of $0,a stock basis of $110,000,and the corporation has a basis for the building of $110,000.

C) If the corporation is a C corporation,Shania has a recognized gain or loss of $0,a stock basis of $100,000,and the corporation has a basis for the cash of $100,000.

D) Only a.and c.are correct.

E) Only b.and c.are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: List the various ways to minimize or

Q20: The § 465 at-risk provision and the

Q33: Carol is a 60% owner of a

Q87: Kirk is establishing a business in 2010

Q88: An S corporation has the same degree

Q93: Rose,an S corporation,distributes land to Walter,its only

Q94: Agnes is going to invest $90,000 in

Q112: Under what circumstances, if any, do the

Q115: The ACE adjustment associated with the C

Q138: Beige,Inc.,has 3,000 shares of stock authorized and