Multiple Choice

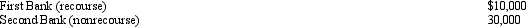

Bart contributes $100,000 to the Tuna Partnership for a 40% interest.During the first year of operations,Tuna has a profit of $20,000.At the end of the first year,Tuna has outstanding loans from the following banks.

What is Bart's at-risk basis in Tuna at the end of the first year?

A) $100,000.

B) $108,000.

C) $112,000.

D) $124,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q21: Sam and Vera are going to establish

Q23: Parrot,Inc. ,a C corporation,distributes $300,000 to its

Q25: Limited partnerships have the same potential for

Q27: In calculating the owner's initial basis for

Q28: Terry has a 20% ownership interest in

Q30: A corporation cannot avoid the accumulated earnings

Q31: Devon owns 30% of the Agate Company

Q58: Samantha's basis for her partnership interest is

Q65: How can double taxation be avoided or