Essay

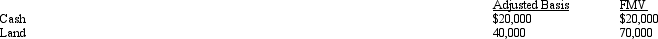

Julie is going to contribute the following assets to a business entity in exchange for an ownership interest.

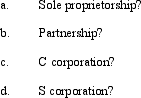

What are the tax consequences of the contribution to Julie if the business entity is a(n):

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: A limited partner in a limited partnership

Q50: The corporate tax rate for a business

Q78: For a limited liability company with 100

Q81: The profits of a business owned by

Q83: Which of the following statements is correct?<br>A)The

Q84: If a C corporation has earnings and

Q84: Colin and Reed formed a business entity

Q96: Factors that should be considered in making

Q121: A major benefit of the S corporation

Q123: Personal service corporations can offset passive activity