Multiple Choice

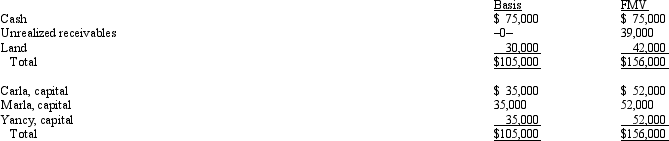

Carla,Marla,and Yancy are equal partners in the CMY Partnership.The partnership balance sheet reads as follows on December 31 of the current year.

Partner Yancy has an adjusted basis of $35,000 for his partnership interest.If Yancy sells his entire partnership interest to new partner Paula for $60,000 cash,how much can the partnership step-up the basis of Paula's share of partnership assets under §§ 754 and 743(b) ?

A) $17,000.

B) $25,000.

C) $35,000.

D) $60,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Jason sold his 40% interest in the

Q23: In a proportionate liquidating distribution,RST Partnership distributes

Q28: In a proportionate liquidating distribution, UVW Partnership

Q34: Generally,gain is recognized on a proportionate current

Q67: In a proportionate nonliquidating distribution,cash is deemed

Q81: Landon received $30,000 cash and a capital

Q84: A partnership continues in existence unless one

Q92: For income tax purposes, proportionate and disproportionate

Q122: William's basis in the WAM Partnership interest

Q156: Francine receives a proportionate liquidating distribution when