Multiple Choice

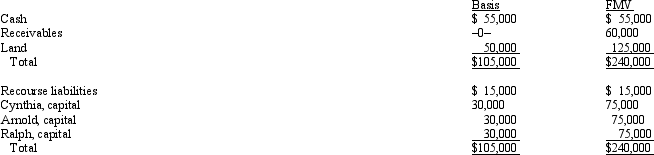

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $80,000 cash.Brandon also assumed Cynthia's 1/3 share of partnership liabilities.On the date of sale,the partnership balance sheet and agreed-upon fair market values were as follows:

If the partnership has a § 754 election in effect,the total "step-up" in basis that Brandon can take in the partnership assets is:

A) $85,000.

B) $55,000.

C) $50,000.

D) $45,000.

E) $20,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Matt,a partner in the MB Partnership,receives a

Q19: In a proportionate nonliquidating distribution of a

Q22: A payment to a retiring partner for

Q25: Tom and Terry are equal owners in

Q55: Last year,Oscar contributed nondepreciable property with a

Q70: Which of the following transactions will not

Q75: The MBC Partnership makes a § 736(b)cash

Q101: The LMO Partnership distributed $30,000 cash to

Q120: A disproportionate distribution arises when the partnership

Q126: If a partnership incorporates, it is always