Essay

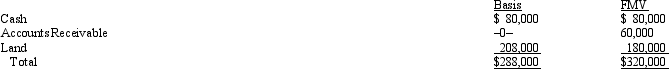

Rita sells her 25% interest in the RSTU Partnership to Nancy for $90,000 cash.At the end of the year prior to the sale,Rita's basis in RSTU was $60,000.The partnership allocates $12,000 of income to Rita for the portion of the year she was a partner.On the date of the sale,the partnership assets and the agreed fair market values were as follows.

Determine the amount and character of any gain that Rita recognizes on the sale.

Correct Answer:

Verified

Rita's basis is increased from $60,000 a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Pat is a 40% member of the

Q26: Carlos receives a proportionate liquidating distribution consisting

Q56: For purposes of determining gain on a

Q57: A distribution can be proportionate even if

Q60: In a proportionate liquidating distribution in which

Q69: On December 31 of last year,Pat gave

Q73: Geneva receives a proportionate nonliquidating distribution from

Q75: Which of the following is not true

Q81: Cindy,a 20% general partner in the CDE

Q147: Which of the following statements,if any,about an