Essay

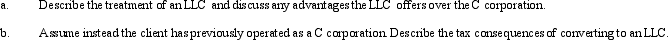

Your client has operated a sole proprietorship for several years,and is now interested in raising capital for expansion.He is considering forming either a C corporation or an LLC.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Catherine's basis was $50,000 in the CAR

Q10: The December 31,2010,balance sheet of the RST

Q13: A partnership has accounts receivable with a

Q25: Rex and Scott operate a law practice

Q25: Tom and Terry are equal owners in

Q35: In a proportionate liquidating distribution in which

Q126: If a partnership incorporates, it is always

Q142: Barry owns a 25% interest in a

Q152: In a proportionate liquidating distribution,Barbara receives a

Q175: For Federal income tax purposes, a distribution