Multiple Choice

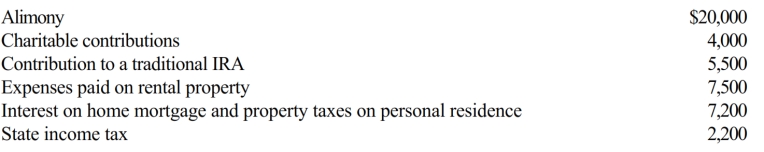

Al is single, age 60, and has gross income of $140,000. His deductible expenses are as follows:

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q30: Walter sells land with an adjusted basis

Q47: In what situations may individuals be able

Q51: Alfred's Enterprises, an unincorporated entity, pays employee

Q128: During the year, Rita rented her vacation

Q129: Marge sells land to her adult son,

Q130: Calculate the net income includible in taxable

Q131: Which of the following statements is correct

Q132: Because Scott is three months delinquent on

Q136: Taylor, a cash basis architect, rents the

Q137: Bridgett's son, Clyde, is $12,000 in arrears