Multiple Choice

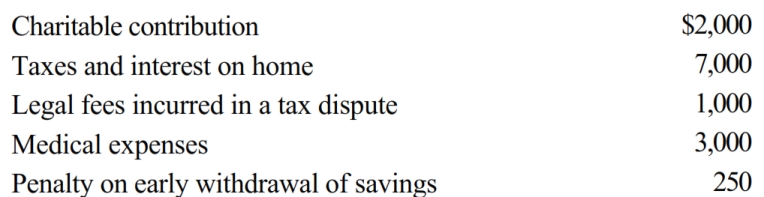

Marsha is single, had gross income of $50,000, and incurred the following expenses:

Her AGI is:

A) $39,750.

B) $49,750.

C) $40,000.

D) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q17: Are there any circumstances under which lobbying

Q19: Graham, a CPA, has submitted a proposal

Q20: Agnes operates a Christmas Shop in Atlantic

Q21: Petal, Inc. is an accrual basis taxpayer.

Q26: Iris, a calendar year cash basis taxpayer,

Q27: Which of the following is not a

Q54: If an activity involves horses, a profit

Q58: Susan is a sales representative for a

Q87: What losses are deductible by an individual