Multiple Choice

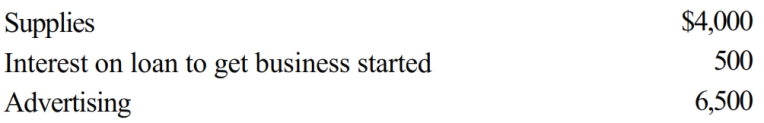

Priscella pursued a hobby of making bedspreads in her spare time. Her AGI before considering the hobby is $40,000. During 2018 she sold the bedspreads for $10,000. She incurred expenses as follows:

Assuming that the activity is deemed a hobby, how should she report these items on her tax return?

A) Include $10,000 in income and deduct $11,000 for AGI.

B) Ignore both income and expenses since hobby losses are disallowed.

C) Include $10,000 in income, deduct nothing for AGI, and claim $11,000 of the expenses as itemized deductions.

D) Include $10,000 in income and deduct nothing.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Legal fees incurred in connection with a

Q32: Alice incurs qualified moving expenses of $12,000

Q33: Which of the following is correct?<br>A) A

Q34: The period in which an accrual basis

Q35: Janet is the CEO for Silver, Inc.,

Q35: The amount of the addition to the

Q37: For a taxpayer who is engaged in

Q38: Melba incurred the following expenses for her

Q61: Purchased goodwill must be capitalized but can

Q100: Fines and penalties paid for violations of