Essay

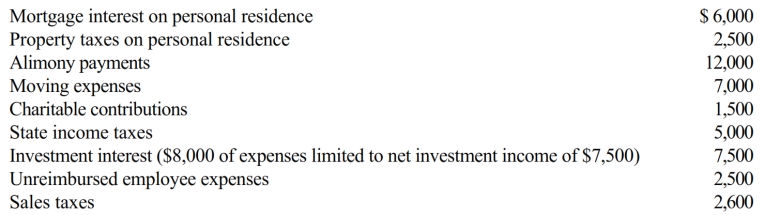

Arnold and Beth file a joint return in 2018. Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q6: Ordinary and necessary business expenses, other than

Q49: Section 212 expenses that are related to

Q72: All domestic bribes (i.e., to a U.S.official)

Q95: In determining whether an activity should be

Q97: If a residence is used primarily for

Q98: For a president of a publicly held

Q102: Trade or business expenses of a self-employed

Q104: If a taxpayer operates an illegal business,

Q105: The portion of a shareholder-employee's salary that

Q144: In applying the $1 million limit on