Multiple Choice

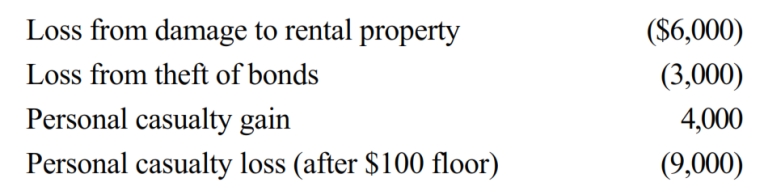

In 2018, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:

The personal casualties occurred in a Federally-declared disaster area. Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: The amount of a business loss cannot

Q10: The amount of a loss on insured

Q14: A business bad debt is a debt

Q80: The amount of partial worthlessness on a

Q82: Peggy is in the business of factoring

Q83: The purpose of the "excess business loss"

Q84: While Susan was on vacation during the

Q86: Last year, Lucy purchased a $100,000 account

Q87: Alicia was involved in an automobile accident

Q88: In 2017, Amos had AGI of $50,000.