Essay

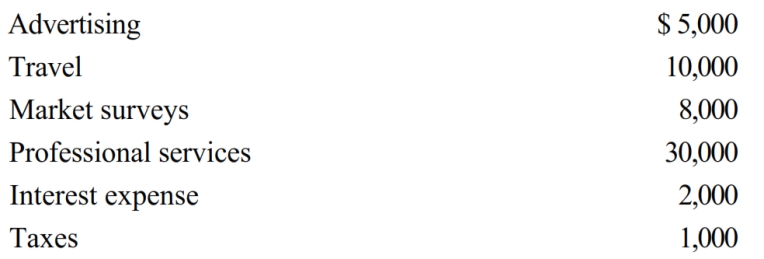

In 2018, Marci is considering starting a new business. Marci incurs the following costs associated with this venture.

Marci started the new business on January 5, 2019. Determine the deduction for Marci's startup costs for 2018.

Correct Answer:

Verified

Marci is not allowed to deduct...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: The cost recovery basis for property converted

Q51: Motel buildings have a cost recovery period

Q90: Nora purchased a new automobile on July

Q91: MACRS does not use salvage value. As

Q92: Audra acquires the following new five-year class

Q93: If an automobile is placed in service

Q96: The cost recovery period for 3-year class

Q97: Residential rental real estate includes property where

Q98: Tan Company acquires a new machine (ten-year

Q99: Augie purchased one new asset during the