Essay

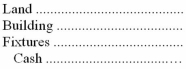

Yell Company made a lump sum purchase of an office building,including the land and some fixtures,for cash of $160,000.The tax assessments for the past year reflected the following: Land,$22,500; Building,$58,500; and Fixtures,$9,000.Complete the following entry for the acquisition:

Correct Answer:

Verified

Correct Answer:

Verified

Q55: The declining-balance method of depreciation is based

Q56: The estimated useful life is the total

Q57: Which of the following is a false

Q59: Non-current assets are those that a business

Q61: The records of Pam Company showed the

Q63: On January 1,20A,Straight,Inc.,purchased a machine with a

Q71: A corporation may choose to list its

Q86: If a second-hand machine is purchased for

Q162: What is the book value of a

Q164: Rebuild Inc. purchased a plant and the