Essay

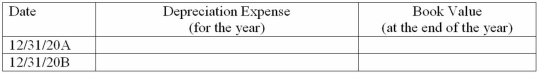

Sutter Company purchased a machine on January 1,20A,for $16,000.The machine has an estimated useful life of 5 years and a $1,000 residual value.It is now December 31,20B,and Sutter is in the process of preparing financial statements.Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: When Ford Motor Company expenses a $200

Q60: Behren Company purchased a building and the

Q83: The cost principle should be applied in

Q135: Which of the following would most likely

Q136: The apportionment of the acquisition cost of

Q137: Since the Capital Cost Allowance is used

Q139: Bethany Company plans to depreciate a new

Q142: What is the term used for matching

Q144: The cost allocation method utilized affects the

Q145: Use of straight-line depreciation will lead to