Essay

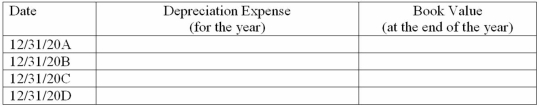

On January 1,20A,Stern Company (a calendar year corporation)purchased a heavy duty machine having an invoice price of $13,000 plus transportation and installation costs of $3,000.The machine is estimated to have a 4-year useful life and a $1,000 residual value.Assuming the company uses the declining-balance method depreciation and a 150% acceleration rate,complete the following schedule (round to the nearest dollar).

Correct Answer:

Verified

* straight line rate: 1/4 = 0.25 Declini...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Belmont Corporation made a basket purchase of

Q62: On January 1, 20A, Reagan Company purchased

Q87: WD Company reports profit in 2012 of

Q88: In 2012,WD Company reported the cost of

Q89: Which of the following is false?<br>A)The book

Q94: Duval Company acquired a machine on January

Q95: What is the main purpose of recording

Q96: In 2012,DAL Co.had a fixed asset turnover

Q97: When either the estimated useful life or

Q115: Carpenter Corporation purchased a mineral deposit, making