Essay

Tweed Feed & Seed purchased a new machine on January 1,20A:

Accumulated depreciation at the end of year 5 (assume straight-line depreciation)$12,000

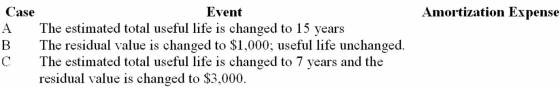

It is now the beginning of year 6 and the management re-evaluated the estimates related to the machine.Compute the depreciation expense for year 6 under each of the following independent cases:

Correct Answer:

Verified

CASE A: (26,000 - 12,000 - 2,000)F1F1F1S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: A company that is self-constructing a new

Q50: On January 2,20D,Daintry Company purchased a patent

Q51: Bubba Inc.purchased an asset on January 1,20A.Bubba

Q54: Raco Inc.purchased two used machines together to

Q55: The declining-balance method of depreciation is based

Q56: The estimated useful life is the total

Q57: Which of the following is a false

Q73: The declining-balance method of depreciation is appropriate

Q80: One of the most important challenges facing

Q183: Building and equipment are recorded at their